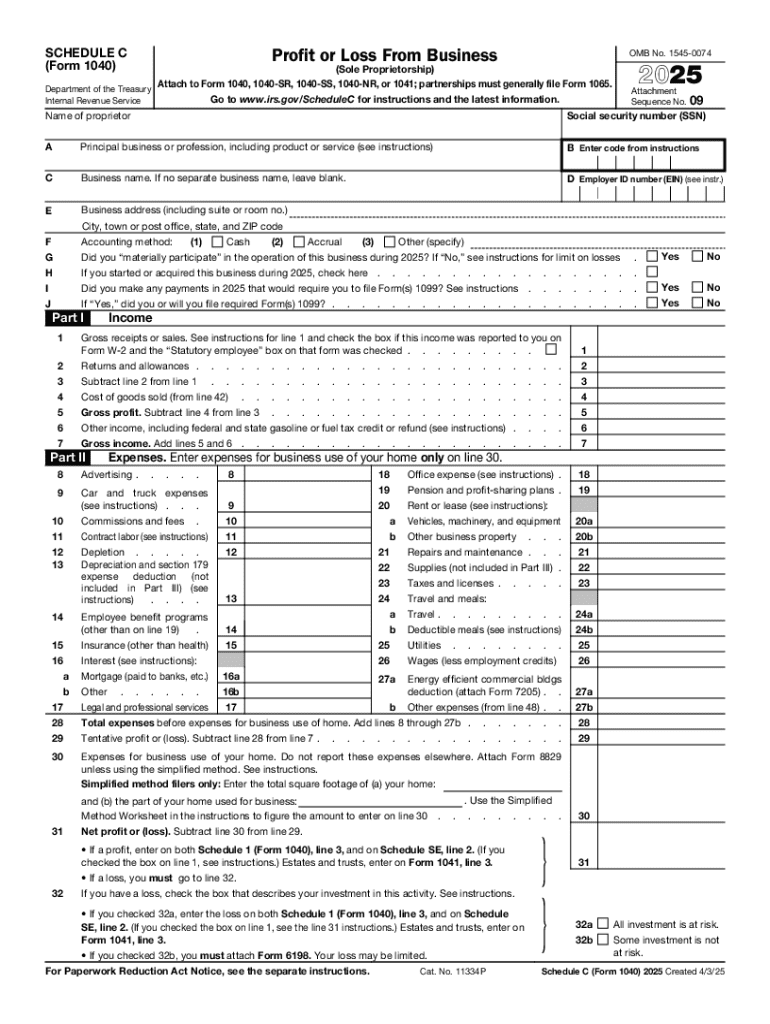

IRS 1040 - Schedule C 2025-2026 free printable template

Instructions and Help about IRS 1040 - Schedule C

How to edit IRS 1040 - Schedule C

How to fill out IRS 1040 - Schedule C

Latest updates to IRS 1040 - Schedule C

All You Need to Know About IRS 1040 - Schedule C

What is IRS 1040 - Schedule C?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

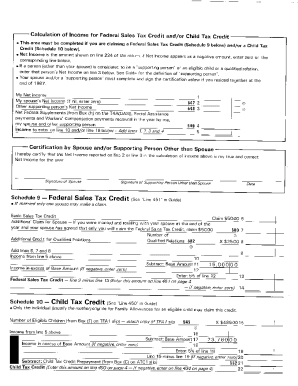

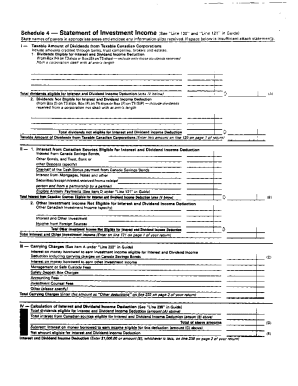

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule C

How can I correct mistakes on my IRS 1040 - Schedule C after submission?

If you need to correct errors on your IRS 1040 - Schedule C after submission, you can file an amended return using Form 1040-X. Make sure to clearly indicate which information is being changed and attach the corrected Schedule C. It's important to act swiftly, as rectifying mistakes can help avoid potential penalties or issues with the IRS.

What should I do if my IRS 1040 - Schedule C e-filing is rejected?

If your IRS 1040 - Schedule C e-filing is rejected, carefully check the rejection code provided by the IRS. Common reasons for rejection include mismatched information or missing data. Correct the issues indicated and resubmit your e-filing to ensure proper processing without further delays.

How long should I keep my records related to IRS 1040 - Schedule C?

It's advisable to retain your records related to IRS 1040 - Schedule C for at least three years after the filing date. This period allows you to be prepared in case of an audit or any queries from the IRS about your business income and expenses.

What are some common errors to avoid when submitting IRS 1040 - Schedule C?

Common errors when submitting IRS 1040 - Schedule C include incorrect calculations, not reporting all income, and misclassifying expenses. To mitigate these issues, double-check all entries, ensure all income sources are included, and classify expenses accurately to align with IRS guidelines.

How can I track the status of my IRS 1040 - Schedule C submission?

To track the status of your IRS 1040 - Schedule C submission, you can utilize the IRS 'Where's My Refund?' tool, which provides updates on your tax return processing. Have your filing information ready for a smooth inquiry, allowing you to confirm if your return has been received and accepted by the IRS.

See what our users say